The Nickel Pickle, The Wire China, May 7, 2023.

By Eliot Chen

Everyone wants Indonesia's nickel. But Xiang Guangda was there first.

The floodlights at Indonesia Morowali Industrial Park stay on throughout the night. Around the clock, more than 40,000 workers operate the 8,000 acre site, which just ten years ago was nothing but dense rainforest on Sulawesi, Indonesia’s fourth largest island. Today, the sprawling park, which many refer to simply as “IMIP,” is home to a port, an airport, dormitories for Chinese workers, a four-star hotel and three mosques.

At its core, however, IMIP exists to smelt and refine at enormous scale a single mineral: nickel.

Long a key ingredient in stainless steel, nickel is increasingly wanted for the production of lithium ion batteries for electric vehicles. By 2040, the International Energy Agency estimates that clean energy technologies will account for as much as 70 percent of total nickel demand.

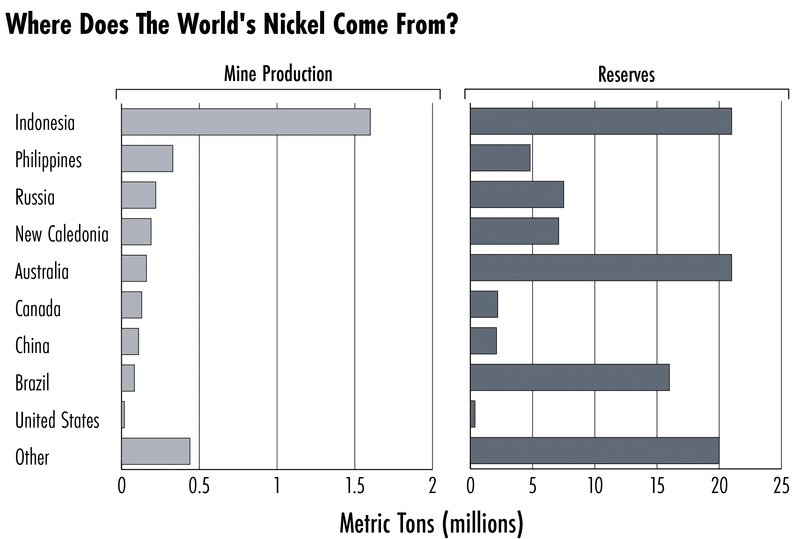

For Indonesia, this presents a huge opportunity: the country is already the world’s largest nickel miner, extracting almost half of the world’s supply in 2022, and it has now set its sights on becoming a major player in the EV supply chain.

IMIP stands as Indonesia’s proof that it can climb up the value chain of its abundant natural resources. Nearly a decade ago, the country embarked on a strategy of ‘resource nationalism’ when the government banned the export of unprocessed minerals, hoping to force foreign companies to invest in local smelting and refining. Back then, the move spooked foreign investors, driving major miners like Rio Tinto to exit the country.

But one foreign investor doubled down: Xiang Guangda, founder of the Chinese stainless steel producer Tsingshan Group.

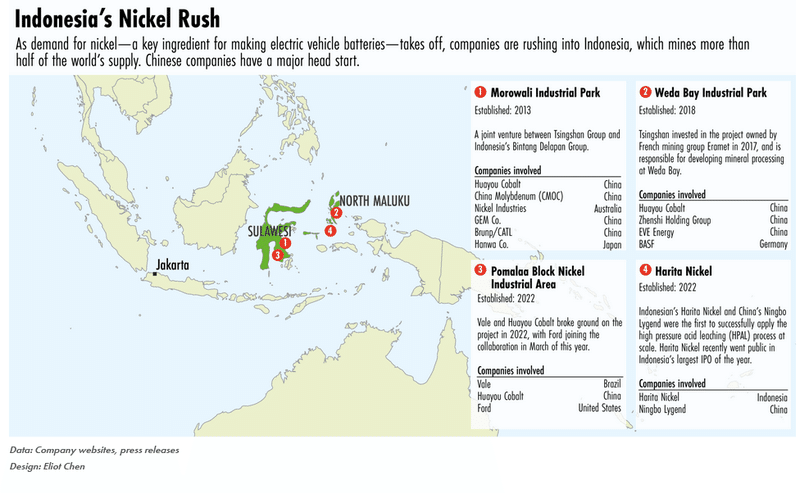

Through a joint venture with a domestic mining company, Tsingshan invested billions starting in 2013 to build the industrial park in Morowali. IMIP is now one of Indonesia’s most important economic hubs, and Tsingshan, once a bit player struggling for relevance against China’s giant state-owned steelmakers, is the largest producer of stainless steel in the world.

It is also something of a gate-keeper for a large segment of Indonesia’s nickel industry, which presents a problem for the West.

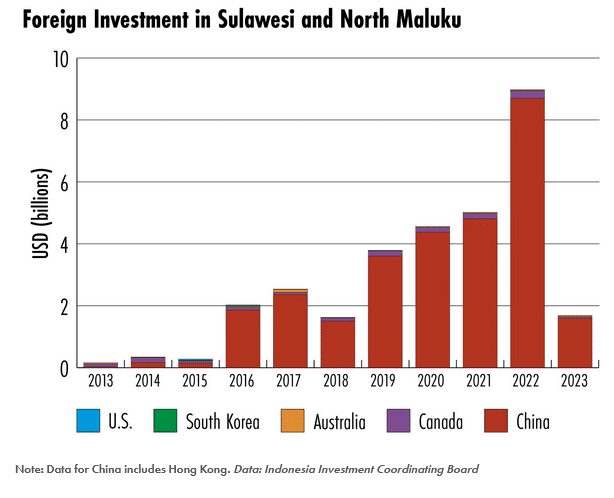

Thanks to the immense success of IMIP and other industrial parks Tsingshan has stakes in, Chinese mining companies (including Zhejiang Huayou Cobalt and China Molybdenum) and Chinese battery makers (including CATL and GEM Co.) have followed Tsingshan’s lead. Over the last decade, China has invested more than $29 billion into the islands of Sulawesi and North Maluku1 — historically underdeveloped regions that are rich in nickel reserves. By contrast, Canada, the U.S. and Australia combined have invested less than $2 billion.

Chinese companies have also built much of the supporting infrastructure around Indonesia’s nickel refineries, effectively giving them control over who has access to them.

“The internet, roads, ports, logistics — most of these were built by Chinese companies,” explains Angela Tritto, an assistant professor at the University of Brunei Darussalam, adding that Tsingshan’s infrastructure footprint has also grown. “There are a lot of companies under the umbrella of Tsingshan. They have an energy subsidiary that runs the coal power plants, for example.”

Representatives for Tsingshan and IMIP did not respond to several requests for comment for this article.

Global investors, eager to secure their supply of one of the twenty-first century’s most critical minerals, are now scrambling to gain a foothold. In March, Ford announced it would invest in nickel processing in Sulawesi, and Indonesia’s investment minister says it will soon be joined there by Volkswagen. France’s Eramet and Germany’s BASF are also investing in Indonesian nickel processing for EV batteries.

“Indonesia is the Saudi Arabia of the global nickel market,” says Cullen Hendrix, a senior fellow at the Peterson Institute for International Economics. “Part of the motivation for Ford and other firms is that they are worried about the thin nature of this supply chain.”

A spokesperson for Ford told The Wire that its recent investment in Indonesia “will help make electric vehicle batteries even more affordable for even more customers.” But it’s unclear if that includes U.S. customers, in part because Ford’s project hinges on a partnership with a Chinese firm, Huayou Cobalt.

The U.S. passed the Inflation Reduction Act (IRA), which introduced tax credits for EVs that meet certain sourcing requirements, with the hope of reducing America’s dependence on Chinese firms. Because the U.S. and Indonesia lack a free trade agreement, cars that include Indonesian minerals are at risk of being precluded from eligibility for the tax credits. Indonesia recently proposed an agreement with the U.S., but the depth of Chinese involvement in Indonesia’s nickel industry could make it a nonstarter.

“Indonesia is going to be the largest nickel producer this decade, and [the U.S.] wants to stimulate sales of EVs,” says Henry Sanderson, author of Volt Rush: The Winners and Losers in the Race to Go Green. “That’s one of the fundamental contradictions of the IRA. It’s going to be hard for the U.S. to advance its climate and geopolitical goals at the same time.”

Especially since Chinese companies like Tsingshan aren’t standing still. Sensing its future is in EVs, Tsingshan is preparing to publicly list a subsidiary, REPT Battero Energy Co., and intends to use the proceeds to rapidly build up battery production capacity. By expanding into the battery business, Tsingshan is poised to become unique among battery makers: with its operations at IMIP and battery plants in China, it will effectively control its entire supply chain, from mine to smelter to battery assembly line.2 As Sanderson notes, not even BYD, China’s top automaker, has that level of vertical integration.

“It would be really powerful if Tsingshan can succeed,” he says.

I would call Tsingshan the Apple of the metals mining industry. They do things so much better and more creatively than other Chinese companies.

Although there are several hurdles to clear — including environmental and labor concerns, not to mention a cut-throat battery market in China — analysts say Tsingshan has pulled off such feats before.

“I would call Tsingshan the Apple of the metals mining industry,” says Jim Lennon, former chairman of commodities at Macquarie, an Australian financial services group. “They do things so much better and more creatively than other Chinese companies. They’re the most dynamic. They’ve led the way.”

A BETTING MAN

People who have met Xiang Guangda, now 65 years old, describe him as unassuming — “ordinary” even, with his penchant for striped shirts and trainers. But they also say he is quietly charismatic, with an unsentimental willingness to change tack and an appetite for big risks.

As a young entrepreneur from Wenzhou, in Zhejiang Province — a region renowned for fostering entrepreneurs — Xiang started his first company in 1988 to make doors and windows for state automakers. But as he explained in an interview with a local media outlet in 2015, after visiting the factories of Mercedes-Benz and BMW in Germany, he realized that neither firm outsourced their doors and windows. Predicting that advances in China’s auto sector would eventually put his company out of business, Xiang decided to abandon it in 1992.

His next venture, incorporated a year later, was Tsingshan — an audacious foray into stainless steel. Although demand for the alloy in China was high, few domestic producers could manufacture it at scale apart from state-owned giants Baowu Steel and Tisco. Xiang’s company grew steadily, but remained a minnow in the field.

Baowu and Tisco had an Achilles heel, however: they were reliant on nickel imports and were therefore vulnerable to fluctuations in its price. In the mid-2000s, as the price of nickel shot up thanks to voracious demand from China and India, Xiang saw an opening. Using its smelters in China, the company figured out how to manufacture stainless steel using nickel pig iron (NPI), a type of nickel alloy produced from a lower-grade ore that is abundantly found in Indonesia and the Philippines.

Stainless steel producers had struggled to effectively make use of NPI due to its low nickel content, which is as low as 4 percent. But using imported nickel ore from Indonesia, Tsingshan pioneered a refining process that produced NPI with a nickel content of up to 30 percent, making it good enough for stainless steel.

In short order, Tsingshan’s business took off. Its stainless steel flooded the market and helped bring nickel prices back down to earth. Facing rising shipping costs and narrowing margins, however, Xiang saw another opportunity to place a big bet — this time on Indonesia.

In 2009, the government of President Susilo Bambang Yudhoyono passed a new mining law, to come into effect in 2014, that banned the export of unprocessed mineral ores. Coupled with longstanding concerns about corruption and mismanagement in the mining sector, many foreign investors packed up their bags. Between 2013 and 2014, output from Indonesia’s nickel mines fell almost 80 percent as miners turned towards alternative sources like the Philippines and Australia.

Xiang, however, doubled down. Recognizing that the cost of transporting heavy, water-laden ore to China was hurting Tsingshan’s margins, the company resolved to relocate its processing plants closer to the source of its raw materials. In 2009, Tsingshan initiated plans to build smelters in the country at a massive scale.

Indonesia was thrilled.

“There has long been a drive towards industrial policy and industrial upgrading among Indonesia’s political elites,” says Alvin Camba, an assistant professor of political economy at the University of Denver. “In terms of resources, Indonesia wants to get out of being an export-oriented economy, to force a step up in production, from mining to smelting.”

Tsingshan secured financing from a coterie of Chinese policy banks — including China Development Bank, China Exim Bank, Bank of China, as well as HSBC China — and set up PT Sulawesi Mining Investment, a joint venture with Indonesia’s Bintang Delapan Group. PT Sulawesi was swiftly granted the rights to mine more than 115,000 acres of nickel ore reserves.

Through a Hong Kong-based subsidiary, Tsingshan also signed an agreement with Bintang Delapan to establish IMIP in October 2013.

For Beijing, the project arrived at an opportune time: Chinese President Xi Jinping had just unveiled his vision for the Belt and Road Initiative (BRI).

“It was a time when Beijing was looking for a big project that could lubricate bilateral relations with Indonesia,” says Jessica Liao, an associate professor of political science at North Carolina State University. While Tsingshan’s vision for IMIP may have preceded Xi’s global infrastructure masterplan, “the timing of the Belt and Road Initiative really just worked in its favor,” she says. Both Xi and Indonesia’s then-President Susilo Bambang Yudhoyono were present at the signing ceremony.

The plan for IMIP was unprecedented in its scope. Using a combination of local and imported Chinese labor, Tsingshan built everything — from electricity to a port to roads — from scratch.

Months later, when the ban on raw mineral exports went into effect, “Tsingshan was all ready to go,” notes Lennon. “They built over 40 furnaces in Morowali and were wildly successful. They quickly became the most efficient producer of NPI the world has ever seen.”

The export ban also gave Tsingshan an advantage on the buying side, since it restricted who could buy Indonesia’s nickel ore. As the sole buyers, smelters like Tsingshan could all but dictate the price, keeping it artificially low. A 2020 research paper by Camba and Tritto describes this outcome as an “oligopsony” — where a small number of buyers exert disproportionate influence on the market.3

Ironically, Tsingshan’s success in bringing down the price of nickel would also inspire founder Xiang’s most infamous blunder. Early last year, Xiang had built up a massive short position on nickel on the London Metal Exchange (LME). But sanctions on Russia, a major nickel miner, following its invasion of Ukraine, and a resultant short squeeze on Tsingshan sent prices skyrocketing instead. Pressure on Tsingshan to meet margin calls brought the company to the brink of collapse, as it faced as much as $2 billion in potential losses.

In the end, the company was saved, in part, thanks to intervention by the LME, which suspended nickel trading for eight days while Xiang struck a deal with Tsingshan’s creditors. (The LME, which is owned by the Hong Kong Stock Exchange, is under investigation from U.K. regulators for possible misconduct.)

Tsingshan’s competitive advantage in stainless steel has also eroded over time. Macquarie estimates that there are now over 200 furnaces in Indonesia devoted to making nickel pig iron — Tsingshan operates about 80 of them — and the market is facing oversupply: the price of nickel pig iron is down around 30 percent compared to the same time last year.

“Tsingshan’s initial task was to become the world’s largest and lowest cost stainless steel producer,” says Lennon. “Now they’ve achieved that, so they’re divesting part of their stainless steel operations — they’re seeing the writing on the wall.”

Indeed, the company is gearing up for its next big gamble: EV batteries.

ENVIRONMENTALLY FRIENDLY NICKEL?

In July 2020, Tesla CEO Elon Musk issued a public plea in the middle of the EV maker’s earnings call.

“I’d just like to reemphasize: any mining companies out there, please mine more nickel, OK? Go for efficient, environmentally friendly nickel mining at high volume,” he said. “Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

Data: USGS

With its cheap and captive supply of nickel and immense processing capacity, it’s easy to assume that Tsingshan would be the first to answer Musk’s call. But for a variety of environmental and social reasons, the company — and Indonesia more broadly — may struggle to do so.

For one, the type of nickel that Tsingshan has perfected the process of refining and the type of nickel needed for EV batteries aren’t a perfect match. Nickel pig iron, which is part of a category known as class II nickel, has a purity ranging between 2 and 30 percent. But the nickel needed for batteries falls into class I nickel, which is refined to a purity exceeding 99.8 percent. The markets for the two nickel classes function discretely, with operators and mines catering to different applications.

Tsingshan, however, could disrupt that; it has spearheaded a resource-intensive approach to refine class II nickel. In March of 2021, the company announced that it had signed contracts to supply 100,000 tons of “nickel matte” to Chinese battery component makers CNGR and Huayou Cobalt — both of which are Tesla suppliers. Nickel matte can be produced using the same furnaces used to produce NPI, and has approximately 75 percent purity. The matte, in turn, can be converted through additional refining into battery-grade class I nickel.

This method of making nickel matte isn’t new, but it is wildly energy intensive: class I nickel produced from matte emits as much as six times more carbon dioxide than the traditional method, according to the International Energy Agency. Considering that nickel already has the highest carbon footprint of all the metals that go into an EV battery, many miners — including France’s Eramet and Canada’s Sherritt International — have experimented with the procedure but ultimately abandoned it due to the high capital and environmental costs.

So far, these issues don’t seem to trouble Tsingshan. IMIP runs exclusively on thermal coal, which Indonesia has in abundance, and Tsingshan’s NPI is already known as some of the world’s dirtiest. Although the company has made bold pronouncements about transitioning IMIP to renewable energy, industry experts say evidence of the projects have yet to materialize.

…it’s hard to look at a place like Indonesia, which is going to have a coal-based power system for a very long time, and believe these companies are going to be green

A second refining process Tsingshan has embraced, known as high pressure acid leaching (HPAL), isn’t much better for the environment. The process relies on mixing nickel ore with sulfuric acid to produce an intermediate product, which can in turn be refined into battery-grade nickel. Although the process is less carbon intensive than producing matte, it does create a toxic byproduct — referred to as tailings — and there are no good ways to get rid of it.

A plan by Tsingshan and other Chinese firms to dump the tailings into the sea provoked an upswell of criticism from environmental groups, and the Indonesian government then banned the practice in 2021. Nickel refiners have since turned to ‘dry stacking’ the tailings — getting rid of the water and then piling the waste landfill-style — but the risk of leakage remains, particularly given the region’s heavy rains.

Tsingshan’s strategies don’t seem poised to align with Musk’s call for environmentally-friendly nickel. But some experts say that, in the long run, the processes embraced by Tsingshan and others like it could increasingly become the only game in town. If the industry embraces refining battery-grade nickel from lower-grade ores, the historical premium fetched by class I nickel could eventually disappear, making it harder for companies to invest in more sustainable sources of nickel.

Tsingshan and other Chinese-owned industrial parks in Indonesia have also been criticized for their handling of labor rights issues. In January, for instance, protests erupted at a neighboring facility owned by another Chinese firm, Jiangsu Delong Nickel Industry, after an explosion killed two Indonesian workers, including one who was burned alive. Local workers were calling for improvements in workplace safety standards, but the protests turned violent after security forces intervened, and two more workers — one Indonesian and one Chinese — were killed.

Industrial accidents in Indonesia’s industrial parks are commonplace, according to Li Qiang, executive director of China Labor Watch (CLW), a New York-based nonprofit that advocates for Chinese workers’ labor rights. In November, CLW published a report detailing how Chinese workers, lured overseas by job opportunities on BRI projects, routinely face exploitation and forced labor. Li says CLW surveyed workers employed at IMIP who experienced abuses, including having their passports withheld and portions of their wages kept in arrears. Conditions worsened during the pandemic when workers were prohibited from returning home.

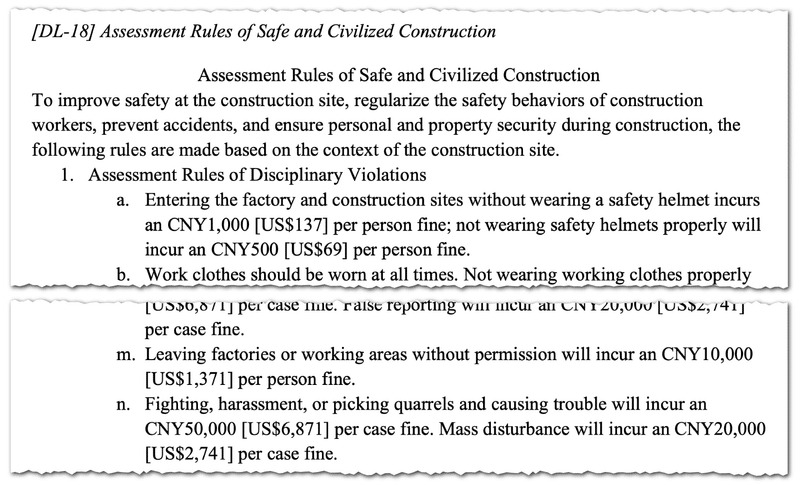

Assessment rules shared by a Tsingshan worker with China Labor Watch show a long list of fineable actions that can result in workers having their wages deducted, including leaving the industrial park without permission. CLW says workers have taken to nicknaming the facility “Tsingshan Prison.” Source: China Labor Watch

“Here’s where the real delicate conversation is,” notes Michelle Foss, a fellow in energy, minerals and materials at Rice University’s Baker Institute. Mining and refining present “a host of problems that are hard for any company to deal with.” Ultimately, when it comes to securing minerals for the green transition, she says, “it’s hard to look at a place like Indonesia, which is going to have a coal-based power system for a very long time, and believe these companies are going to be green.”

In the short term, however, analysts warn that a deficit of battery-grade nickel looms, which is why some Western firms aren’t waiting for perfect conditions to set up shop in Indonesia.

“There’s enthusiasm for projects in this sector, which everyone says is going to grow for the next 30 years,” says Adrian Gardner, principal analyst for nickel markets at Wood Mackenzie, a research and consultancy group. “Governments are on board, with their targets for CO2 emissions; Detroit and Co. are on board, with their EV production targets. So everyone who’s got money and who can make laws is on board now.”

Given Indonesia’s dependence on Chinese firms, it can also feel as if more than just EV supply chains are on the line. Thanks to Indonesia’s strategic position in the Indo-Pacific — its islands bisect key maritime trading routes linking Europe, Oceania and Asia — the West is looking to strengthen relations with the country and counterbalance its growing ties to China. Some analysts have noted with alarm that China-Indonesia relations have improved under the current president, Joko Widodo (better known as Jokowi), who prides himself as Indonesia’s “infrastructure president.” In addition to IMIP, both governments have celebrated another BRI project: a high speed railway linking Jakarta to Bandung built with Chinese engineering.

“Jokowi has a lot of interest in forging ties with China — not because of ideological affinity, but because he’s always been more pragmatic,” says Gatra Priyandita, an analyst at the Australian Strategic Policy Institute, who also studies Indonesian foreign policy. “China provides solutions to two of Indonesia’s biggest challenges: infrastructure and human capital. The U.S. doesn’t invest nearly as much as China has.”

At the same time, Indonesia does not want to be locked out of the U.S. market. In April, it announced that it would propose a limited free trade agreement with the U.S. so that its minerals could make their way into American cars. Such a deal, some observers argue, could deepen relations between the two countries.

Right now Indonesia is doing a great job hedging between the U.S. and China, but also hedging between different trends in global trade, both towards and against globalization.

“Indonesia has a cooperative but also competitive relationship with China in the Indo-Pacific,” says the Peterson Institute’s Hendrix. “It already cooperates with the U.S. on military and maritime issues. Helping Indonesia diversify its export market for nickel would also help it seek balance against China’s rising power in the Pacific.”

Rice University’s Foss, meanwhile, argues that accepting Indonesian nickel — and all of the Chinese strings attached — would violate the spirit of the Inflation Reduction Act.

“The bottom line is, either you draw a line in the sand and stick with it, and say [the IRA] is a serious thing. Then we really have to figure out how to source material in a way that doesn’t create new dependencies and supply chain risks,” she says. “Or, we admit that we’re not that serious, and so maybe some China-sourced material doesn’t matter.”

Where most experts agree is that it is all but impossible to use Indonesia’s nickel without accepting some level of Chinese involvement. Benchmark Mineral Intelligence, a research firm, projects that by 2030, projects with zero Chinese investment will account for less than 7 percent of Indonesia’s supply.

“The Chinese have the advantage in that their technology is both cheap and advanced,” says Muhamad Ikhsan, a senior researcher at the Paramadina Public Policy Institute, an Indonesian think tank. He notes that even the largest non-Chinese investors like Vale are partnered up with Chinese firms. “Definitely they are more productive. Nobody wants to compete with the Chinese.”