Prospect on US stock market next week (Sep 18th~Sep22th)

1.Introduction

There was a lot going on in the markets this week. The first half of the week saw a series of bond issues in the U.S., as expected. In the U.S. Treasury bond auctions, the 3-year note did well, but the 10-year and 30-year bids were not so good. The headline CPI, which had been the focus of attention, was up sharply due to higher energy prices, but in general did not negate the slowing trend in inflation, which was not a major concern for the Fed. In the U.S., the House of Representatives reconvened and Speaker McCarthy ordered an investigation into the impeachment trial against President Biden; in the 12 federal budgets that need to be passed by the end of September, the House finally passed one; and in the House of Representatives, the House of Representatives passed the first of the 12 budgets that need to be passed by the end of October. On October 14, retail sales and PPI were released in the U.S., both of which were much stronger than market expectations. The market is increasingly convinced that this will be the last rate hike. In Japan, the 20-yr bond auction and the 5-yr common collateral operation, which had been a cause for concern, came out strongly, and over the weekend there were reports from BOJ sources that the market misunderstood an article by Governor Ueda regarding the possibility of an earlier lifting of negative interest rates, but in general, the yen rate is stuck around the 0.7% level. However, in general, yen rates are hovering around the 0.7% level. Prime Minister Kishida has reshuffled his cabinet, but this was done with an eye on political affairs, not policy, and the reshuffle has failed to restore support for the government. On a brighter note, the successful IPO of ARM somewhat erased concerns about SoftBank Group's finances and helped drive Japanese stocks higher. And a market disruptor is the fact that the United Auto Workers (UAW) has launched its first joint strike against the Big 3. I will explain this later. Let's get the market situation straightened out for the rest of the week. This week will be a simplified version.

2.The key word for U.S. stocks is "ASEAN.

I like to simplify market points. I do something like a word cloud. That way, it will be memorable. If I were to organize the stock market for the second half of this year and next year, I think of "ASEAN" for U.S. stocks and "BRICS" for Japanese stocks. In this issue, I will briefly address ASEAN for U.S. stocks; ASEAN (ASEAN) has nothing to do with Southeast Asia. It is an acronym for the English word below.

A : Anomaly

S:Semiconductor cycle

E:EPS

A:AI

N:Normalization

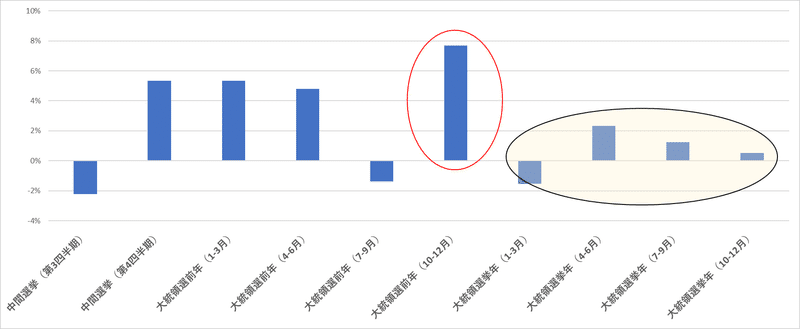

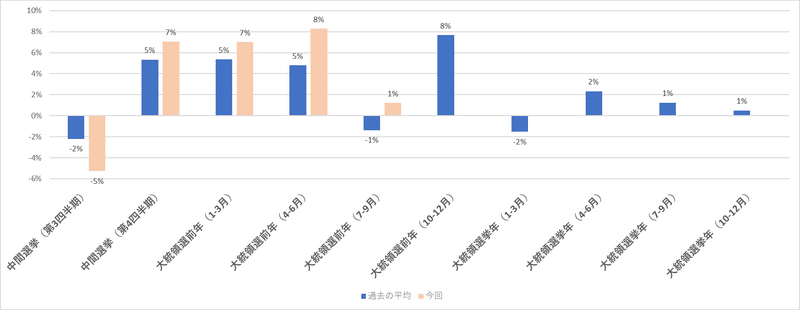

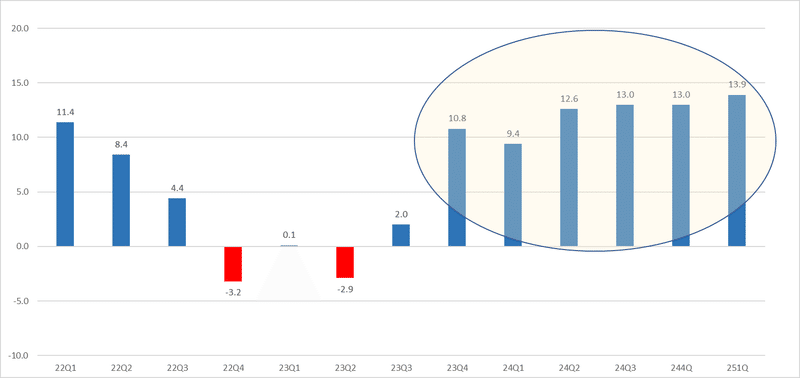

The first A is an anomaly. It is suddenly suspicious. Anomalies are rules of thumb from the past and have no basis in fact. However, market participants value past rules of thumb. Therefore, when there is a strong anomaly, an overvalued P/E ratio or an undervalued P/E ratio is easily justified at that time. The graph below shows the S&P 500's anomaly for the quarter between the midterm U.S. presidential election and the main race. It is an average of the last eight presidential elections. Needless to say, 2024 is a presidential election year. As shown in the yellow shading below, performance has been stable at lower levels in presidential election years. In contrast, performance in the fourth quarter, one year before the presidential election, is quite strong. (Red circles)

What is the situation with these anomalies this time around? The skin-colored bars in the graph below show the situation up to this point in time: September is in the middle of the process, so the results are not yet available, but the market is moving almost in line with the anomaly. This would naturally lead the market to expect the fourth quarter to be the phase in which stock prices are most likely to rise. If the anomaly is correct, the stock market will be dull until the end of September, but will rise by nearly 8% toward the end of the year. This expectation will support U.S. stocks.

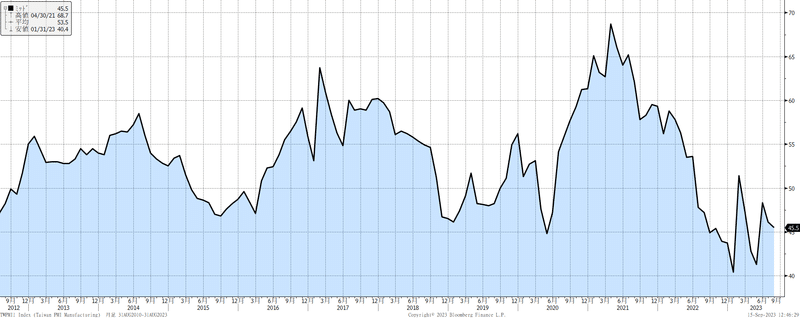

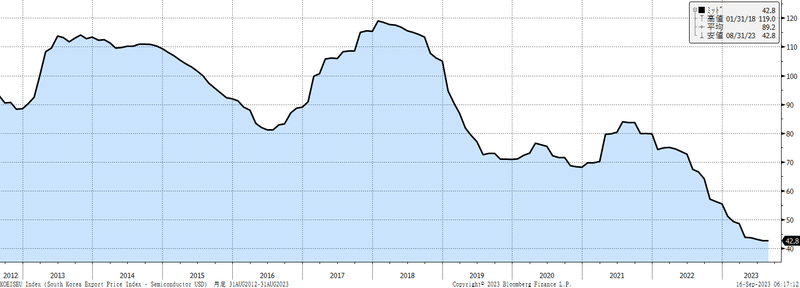

The second "S" is the semiconductor cycle. The semiconductor cycle is in the bottom zone, and the common view of managers of semiconductor-related companies is that the semiconductor cycle will recover in the second half of this year or in 2012. The chart below shows the Taiwanese manufacturing PMI and the South Korean export price index for semiconductors, which indicates that the semiconductor market is still in a weak state at the moment.

The graph below shows the actual and projected year-on-year growth rate of semiconductor sales from the World Semiconductor Market Statistics (WSTS). For the world as a whole (blue), -10.3% is expected this year, with an 11.8% recovery next year. The skin color is for the U.S. and light blue is for Japan. The U.S. is expected to grow by 17.7% next year. The expectation that the semiconductor cycle will recover next year will support the EPS forecasts of semiconductor-related companies.

The third "E" is "EPS. The graph below shows the EPS forecast at the current stage. At one point in the second quarter of this year, a profit decline of about -8% was expected, but the results were better than expected and came in at about -2.9%. Then in the third quarter, profits increased by 2%, and then from the fourth quarter onward, double-digit profit growth is factored in that will continue until a whopping Q1 of 2013. The current P/E ratio of the S&P500 is often pointed out to be overvalued, but if one can believe in such a high EPS growth in the future, the current P/E ratio will decline in the future, which is no obstacle for bullish players.

The question will be how much the above strong EPS forecast will be revised downward. There is a reasonable chance of that. The possibility is reasonable, as corporate costs are definitely on the rise. In addition to these financing costs, companies' costs will continue to increase due to rising energy prices and the recent increase in wages for workers. Until last year, U.S. companies were able to pass these costs on to their prices and make a reasonable profit. The sentiment of the U.S. consumer did not decline. However, we do not know what the future holds. How will the U.S. economy change? Will companies be able to pass on prices? We know that companies' costs will increase, but how they will be able to cope with this is an unknown. Within the ASEAN of key words, the risk factor is a collapse in EPS for US companies, which are currently viewed as very strong. While this is not a major concern at this time, we must be careful here.

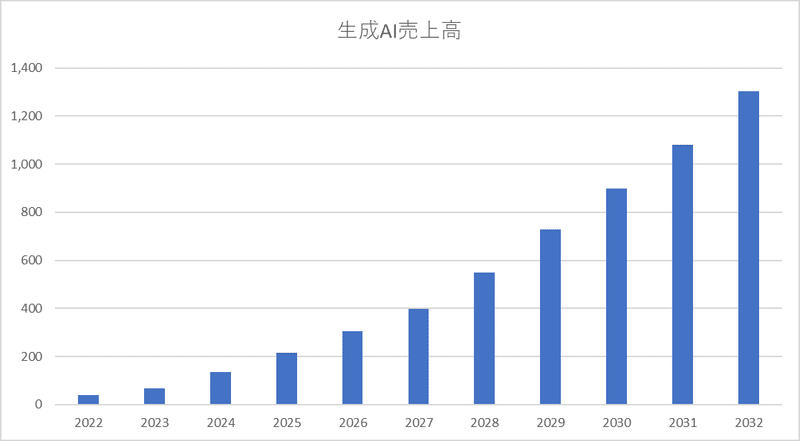

The fourth "A" is expectations for generative AI. There are many ways to look at how fast generative AI will grow, transform society, and create business opportunities there. Blumberg forecasts phenomenal growth over the next decade. (see chart below)

What is important, however, is that this generative AI is in its infancy, and there is a huge amount of money being invested in it. This trend should intensify. Even in the most recent financial results of Big Tech in the U.S., Microsoft invested $10.7 billion in the April-June quarter. In the January-March period before that, it was $7.8 billion. Meta invested $6.4 billion in the April-June quarter and $7.1 billion in the January-March quarter, while Google invested $6.9 billion and $6.3 billion, respectively. This is how much capital investment is being deployed on a quarterly basis. We do not know how the market for generative AI will develop. What is certain, however, is that at the center of it will be U.S. companies. And the existence of such an uncertain but promising area of significant growth is a justification for the overvalued PER.

The last "N" is monetary normalization, i.e., the process by which the Fed ends its excessive rate hikes to deal with inflation and moves toward rate cuts. As shown in the chart below, the market has factored in multiple rate cuts by the Fed over the next 24 years. Even if the economy does not slow, this forward-looking rate cut incorporation will hold. This is because the current FF rate is more than double the neutral rate of 2.5%, and if inflation continues to slow, the FF rate is too high. The expectation that this Fed rate hike will end and that rate cuts will begin next year to normalize monetary policy, rather than easing, will support stock prices. It justifies the overpriced P/E ratios.

3.The strike by the United Auto Workers of America

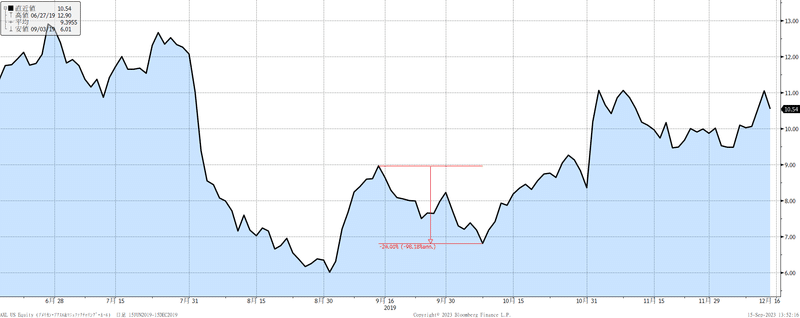

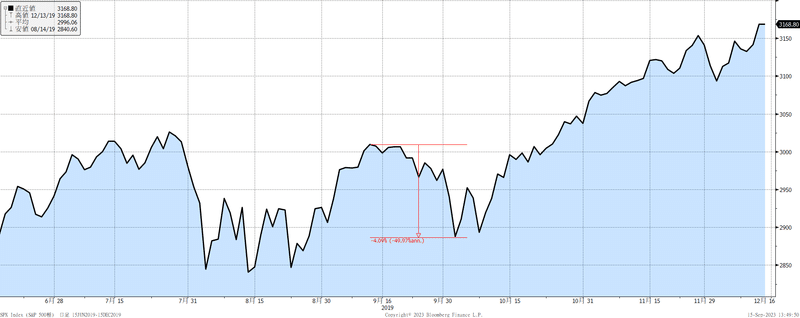

As we have discussed in this Note, the labor-management negotiations between the United Auto Workers (UAW) and the Big Three have gone beyond the 14-day deadline due to the wide divergence. And it appears that the UAW will begin phasing in the first ever "simultaneous strike" of the Big 3. First, let's take a look back at the situation during the 40-day strike against GM in 2019, which was notable for being the first major strike in the U.S. auto industry in decades. The chart below shows GM's stock price at the time. The strike began on September 16 and lasted until October 25, during which time the stock price fell about 14%.

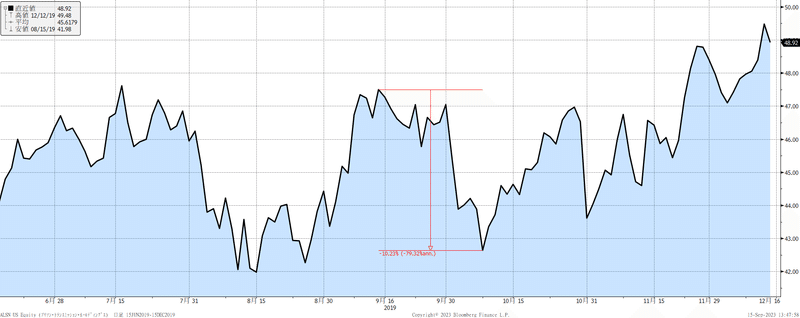

The stock prices of GM's suppliers were also significantly affected. Below are the stock prices of some of GM's suppliers. You will see that the stock prices of all of them have fallen by 10% to 20%.

The S&P 500 as a whole is also down about 4%.

Now, a strike of this magnitude has a considerable impact, but the important point is that labor-management negotiations will always be concluded at some point. And after the conclusion of negotiations, stock prices have risen significantly. In other words, in light of past experience, a decline in stock prices due to the strike would be a buying opportunity. However, three points require caution this time around: first, the UAW strike is the first "Big Three strike en masse," and its impact could be greater than in 2019. Furthermore, UAW Chairman Fain's strategy of "small strikes" is to expand the scope of the strike little by little as negotiations progress. This means that labor-management negotiations could be protracted and that the market is unlikely to factor in the worst-case scenario. If this strike is prolonged, the manufacture of new cars will be delayed and used car prices will soar. Second, depending on the content of the negotiations, stock prices may not rebound after the conclusion of the strike, but may instead decline more. (3% raises in the second and fourth years of the four-year contract, and 3% and 4% lump-sum payments in the first and third years.) Other than that, there were many other things decided in the labor-management negotiations, but basically the negotiations were about "wages and bonuses. In the U.S., this level of negotiation was normal, and the impact on corporate performance was not serious. Hence, after the negotiations were concluded, stock prices rose due to the lack of uncertainty. However, UAW Chairman Fain's demands are not that simple. The company proposed a 20% wage increase over four years, but Chairman Fain is demanding 36%, which is an incomparable wage increase to what the company was demanding in 2019. And more unacceptable to the corporate side are the resumption of defined benefit pension payments and post-retirement health care coverage. The defined-benefit pension plan has been a financial burden for GM and other companies, and in 2012 GM finally reformed the plan, shifting to a defined-contribution plan rather than a defined-benefit plan. GM has also established a medical trust (VEBA) to provide some level of medical benefits to its employees. If GM were to reverse this history and agree to do so, the financial burden on GM would be immeasurable. The conclusion of the negotiations could cause the stock price to fall, as GM would be at a great disadvantage vis-à-vis rivals such as Tesla. Third, there is the impact on the Biden administration. The Biden administration has intervened in these labor negotiations. Michigan, Ohio, and Wisconsin are battleground states in the presidential race. It is likely that the Biden administration wants to avoid at all costs the prolongation of this strike and the deterioration of the economy in these areas. However, in cases where strikes are prolonged despite the Biden administration's active involvement, the Biden administration's credibility and ability to adapt will be criticized. Thus, this strike is a cautionary tale in many ways. I hope that the strike will be settled with a win-win, mutually constructive compromise at an early stage.

That concludes this week. Next week will be filled with the FOMC meeting and the BOJ monetary policy meeting, but it will not be too eventful. I will cover them in detail next week. Have a good weekend!

この記事が気に入ったらサポートをしてみませんか?