中小企業、身を切る賃上げ 気ままなリライト134

In 2024, the annual spring wage negotiations between labor unions and corporate management in Japan have cast an optimistic light, especially for the current and would-be regular employees in the large corporate sector. This year's successful wage increases are kindling a hopeful perception that Japan's economic outlook is gradually shifting away from its longstanding deflationary mindset, even though the actual economic landscape remains challenging. The stark contrast in the eagerness to raise wages among large corporations compared with their smaller and medium-sized counterparts is unveiling the complex reality of Japan's corporate hierarchy.

In the latest round of wage negotiations, numerous large corporations have distinguished themselves with their generous pay raise proposals, aligning closely with, or even exceeding, union demands. Particularly, corporate giants with a global footprint, such as Suntory Holdings, Nippon Steel, and Suzuki Motor Corporation, have taken a proactive stance in those negotiations, offering settlements that meet or surpass the expectations set by their unions.

The collective bargaining achievements of the Japan Metal Workers' Union (JCM), which encompasses four major unions representing employees mostly from large manufacturing corporations, have demonstrated the ample financial capacity of those corporations to accommodate wage increases. From those negotiations, the average wage increase reached an unprecedented 70% year-on-year, elevating the figure to 9,593 yen. It surpassed the previous decade's peak observed in 2023. This amount represented a pay-scale hike of 3.5%, yet, when the cumulative effect of regular wage promotion is considered, the total effective growth exceeded a pay raise of 5%.

Manufacturing sectors have been at the forefront of advocating for wage increases, impacting even small and medium-sized enterprises (SMEs). Japan Association of Metal, Machinery and Manufacturing Workers (JAM), which unites approximately 2,000 individual labor unions (unit unions) with a total of 390,000 members across various industries including machinery, electrical, automotive, steel, and housing-related equipment, reported notable wage growth based on the surveys conducted among SMEs with fewer than 300 union members. As of March's end, an average wage increase of 4.12% was recorded. The amount reached 7,270 yen, marking a 40% increase compared with the previous year and setting a new record since JAM was established in 1999. Within this group, 60% of unions have fewer than 100 members, and a quarter have no more than 30 members. Out of the total, 94 unions, which account for 25% of the SMEs surveyed, achieved wage increases exceeding 10,000 yen.

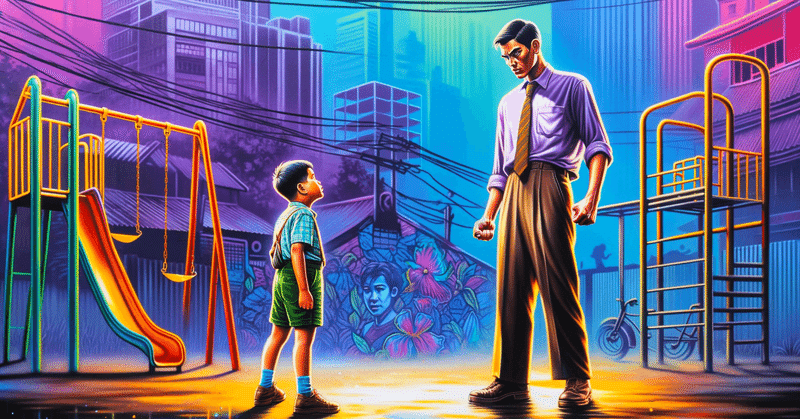

Amidst the strategic push by many large corporations to boost wages as a means of attracting and retaining young talent in a highly competitive landscape, actually putting those raises into practice has proven to be a major challenge, especially for SMEs. In terms of the labor share, which reflects the portion of corporate income dedicated to paying employees, SMEs recorded a labor share of 72.9%, an increase of 1.7 points during the period between October and December in 2023 from the same previous period. This was in sharp contrast to larger corporations, which had a significantly lower labor share of 37.7%, a decrease of 3.2 points. Despite their desire to attract and retain employees with higher wages, many SMEs, particularly those without labor unions, have found themselves in a financial bind, struggling to support wage growth. Those companies have felt the squeeze from deteriorating economic conditions, marked by escalating costs and a shrinking pool of younger workers. The impressive labor compensation offered by larger companies has only heightened the sense of urgency among smaller firms, pushing them in a tight corner as they have grappled with the dilemma of raising wages in the face of the daunting task of passing on the additional labor costs to their customers or prime contractors without losing them. In this challenging scenario, some resilient SMEs dared to rise to the occasion, offering a modest pay rise of 2.23% to maintain their workforce.

The interplay between capitalistic motives and ethical values is essential for ensuring the fair distribution of corporate profits. Often, large corporations source funds for wage increases by reducing the prices they pay to SMEs, who serve as their subcontractors. This dynamic enables prime contractors to dictate advantageous terms, perceiving subcontractors as expendable assets or mere instruments for achieving their profit-driven goals. An emphasis on immediate profits over enduring partnerships tends to promote the exploitation of subcontractors, as prime contractors fail to acknowledge a critical role the equitable treatment of subcontractors plays in their broader success and reputation. Driven by a focus on capitalism, this mindset obscures the distinction between equitable and unfair practices, dismissing subcontractors' reasonable requests for price negotiations to accommodate rising labor costs in their selling prices.

この記事が気に入ったらサポートをしてみませんか?