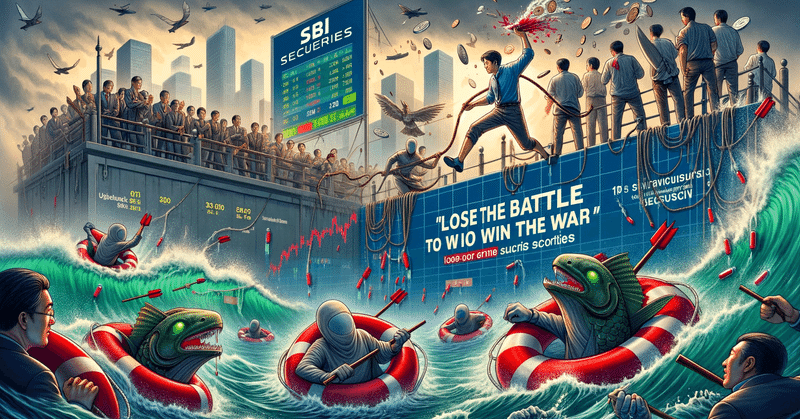

SBI 証券、損を覚悟の大局的な戦略、ライバルを出し抜けるか 気ままなリライト67

SBI Securities is mapping out a “lose the battle to win the war” strategy when they are smelling blood in the water of online securities market. By doing what other online securities companies are unwilling to take a chance on, SBI is improving the odds of winning larger shares at the cost of the apple of their eye. Watching SBI’s spirit of adventure demonstrated by letting go of transaction fees of Japanese stocks, other rivals are sitting on the fence without revealing any service incomparable, unrivaled, one of a kind while grasping their transaction fees as a life-saving rope in the water.

SBI Securities has decided to bet on the marked-down fee competition hovering over the 0.01 percentage range in Japanese stock’ online transaction to beat other rival players by offering a zero-fee transaction service. Initially aimed at traders aged 25 or younger, the target market has been expanded to all age groups by the end of September. The estimated cost of the bet for SBI is equivalent to about 20 billion yen per year, with transaction fees for Japanese stocks accounting for about 15 billion yen of the total sales of 126,5 billion between April and December 2022. A SBI executive says, “Free service in Japanese stock transactions will be a blow on the head. We are ready to take pains to strengthen our magnetic power to pick up what will blow out of our pocketbook in other areas such as U.S. stock exchange, foreign exchange and security-token based real estate finance.”

Other rivals have been reminded of the daredevilry of Spider-Man by the challenge, presented by SBI Securities, of not taking transaction fees from Japanese-stock traders. That is because a banquet of transaction fees has been preventing most online securities companies from sliding down in a swamp of red ink. Among the online securities companies feeling outflanked are Matsui, Rakuten and Monex securities. For them, following in SBI’s footsteps feels reckless. For instance, Matsui's proportion of transaction fees in Japanese stock trades is higher than SBI's at just over 10%, with over 40% of its total sales, coming from 10 billion yen as transaction fees between April and December 2022. That is making it hard for Matsui to squeeze under the pole of zero-transaction fee by bending backwards in the situation in which Matsui is making profits by charging 0.034 % of the total traded value as transaction fees.

SBI’s pre-emptive attack on the online securities market is likely to serve as a thunderbolt to put other rivals into a crucible where the competition to vie for a chance to get lager batches of shares would get fierce in the online trader’s market. To defy the odds, Matsui is focusing on honing call center clerks’ hospitality skills while appealing to traders’ loyalty to Matsui brand. With fire in their eyes, Rakuten is waiting to drop a bombshell for the perfect timing when they would get ahead of others. In the competition among online securities companies over new holders of Nippon Individual Savings Account (NISA) scheduled to be opened in 2024, would SBI’s advantage of the proactive zero-transaction-fee strategy work as a launch pad to scoop more NISA’s management fees than other rivals?

この記事が気に入ったらサポートをしてみませんか?