2023 Oct 26, US Market

Amazon Q3 23 Earnings $AMZN

EPS 94c, est. 58c

Net sales $143.08b, est. $141.56b

AWS net sales ex fx +12%, est. +12.4%

Oper Margin 7.8%, est. 5.46%

Oper Income $11.19b, est. $7.71b

Online stores net sales $57.27b, est. $56.82b

Subscription services net sales $10.17b, est. $10.13b

Physical stores net sales $4.96b, est. $4.99b

Sees 4Q net sales $160.08 to $167.0b, est. $166.57b

See Q4 Oper income $7.0b to $11.0b, est. $8.71b

Intel Q3 2023 Earnings

Rev. $14.2b, est. $13.54b

Adj EPS 41c, est. 21c

Mobileye rev. $530m

Datacenter & ai rev. $3.8b, est. $3.94b

Client computing rev. $7.87b, est. $7.35b

Sees 4q rev. $14.68 to $15.6b, est. $14.35b

Sees 4q adj EPS 44c, est. 31c

Sees 4q adj gross margin 46.5%, est. 44.2%

US 7 Year Note Auction

Bid-to-cover ratio 2.70

High yield 4.908% vs 4.910% presale WI yield

Sells $38 bln

Awards 92.44% of bids at high

Primary dealers take 10.98%

Direct 18.4%

Indirect 70.62%

ECB Policymakers agreed to debate PEPP reinvestment end date this winter, and minimum reserves as part of the framework review - Sources.

A pullback in megacap technology stocks deepened Thursday, dragging the Nasdaq Composite into its worst two-day decline of the year.

A recent round of quarterly earnings reports has tamped down this year’s rally in big-tech shares. Third-quarter results from tech giants this week have mostly failed to impress investors, injecting volatility into the stock market. The S&P 500’s year-to-date gains have shrunk to 7.8%.

Shares of Meta Platforms fell 3.7% after the Facebook parent beat Wall Street expectations in its latest quarterly earnings report, but warned of softer advertising sales in the fourth quarter.

Google parent Alphabet’s Class A shares dropped 2.7%. The stock has struggled since the tech titan reported disappointing cloud business growth after the market closed Tuesday. Microsoft lost 3.8% on Thursday, while Apple fell 2.5% and Nvidia shed 3.5%.

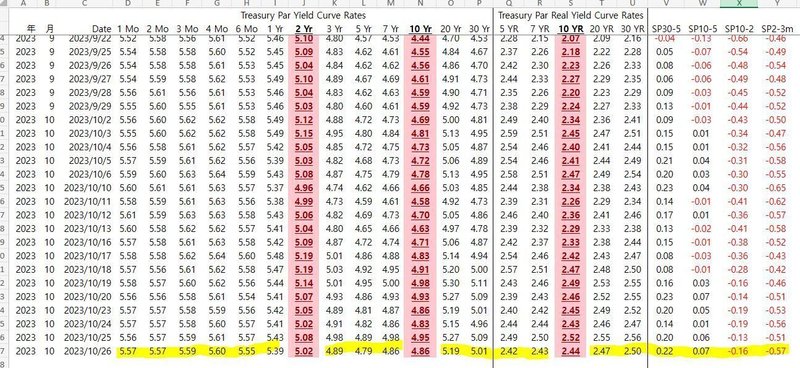

Megacap tech stocks have also lost some of their luster as bond yields have climbed in recent weeks. The yield on the benchmark 10-year Treasury note, which climbed above 5% intraday on Monday for the first time in 16 years, eased to 4.843% on Thursday.

Investors parsed the U.S. gross domestic product report for clues about the trajectory of the economy. Third-quarter GDP rose 4.9% from the year prior adjusting for seasonality and inflation, topping economists’ forecast.

The stronger-than-expected GDP figure suggested consumers are keeping the economy churning, holding a recession at bay. Still, some investors wondered whether the third quarter marked a peak in growth. The report showed Americans saved less and their incomes fell when adjusted for inflation. Business investment stalled, too.

The hot GDP growth rate renewed questions about whether the Federal Reserve is done with its interest-rate increases. Traders are betting the Fed will almost certainly hold its benchmark rate at current levels in its November policy meeting, but are pricing in a roughly 20% probability that the central bank will raise rates in December, according to CME Group’s federal-funds futures.

Meta Platforms (META) reported upbeat Q3 results and provided wide-ranging Q4 revenue guidance

IBM (IBM) reported better-than-expected Q3 earnings and reiterated its FY23 revenue growth guidance

The UAW reached a tentative agreement with Ford (F)

Merck (MRK) reported upbeat Q3 results, but lowered its FY23 earnings guidance

Silver Lake is considering taking Endeavor (EDR) private

Negotiations to merge Western Digital's (WDC) semiconductor memory business and Kioxia Holdings have been terminated, Nikkei says

Spotify (SPOT) plans to make changes to its royalty model to support 'legitimate' artists, MBW says

ConocoPhillips (COP) is considering an offer for Permian producer CrownRock, Reuters reports

General Motors (GM) and Stellantis (STLA) will meet with the UAW seeking a tentative deal, Detroit Free Press reports

Microsoft (MSFT) reshuffled its Xbox and marketing leadership, The Verge reports

Impinj (PI) higher after reporting quarterly results and provided guidance for Q4

ImmunityBio (IBRX) gains after the FDA accepted for review the company's resubmission of its BLA for N-803

Blueprint Medicines (BPMC) and Sunnova Energy (NOVA) advance after reporting quarterly results

Align Technology (ALGN) falls after reporting quarterly results and cutting its FY23 guidance

MaxLinear (MXL) and Expro Group (XPRO) fall after reporting quarterly results

UPS (UPS) reported Q3 results and cut its FY23 revenue guidance, with CEO Carol Tome commenting, "unfavorable macro-economic conditions negatively impacted global demand in the quarter"

Hershey (HSY) reported Q3 EPS and revenue that beat consensus

MasterCard (MA) announced Q3 results, with CEO Michael Miebach commenting, "We delivered strong revenue and earnings growth again this quarter

Mattel (MAT) reported Q3 and raised its FY23 guidance

Hasbro (HAS) reported Q3 EPS and revenue that missed consensus

HSBC upgraded Microsoft (MSFT) to Buy from Hold with a price target of $413, up from $347. The firm sees an improved outlook following the company's stronger than expected fiscal Q1 results.

Oppenheimer upgraded Adobe (ADBE) to Outperform from Perform with a $660 price target. The firm sees strengthening business momentum, a favorable outlook for fiscal 2024, and "durable growth" for Adobe based on positive fundamental trends and its top position in software for the generative artificial intelligence opportunity gleaned from the firm's customer and industry surveys. DA Davidson also upgraded Adobe to Buy from Neutral with a price target of $640, up from $500.

Guggenheim upgraded Akamai Technologies (AKAM) to Neutral from Sell without a price target. The firm sees potential upside to current 2024 Street estimates, which the firm believes creates a more balanced risk/reward scenario for the shares.

Evercore ISI upgraded Live Nation Entertainment (LYV) to Outperform from In Line with a $100 price target. The firm says the regulatory overhang, uncertainty about 2024 growth, and upside to near-term estimates creates an attractive entry point for the shares.

Northland upgraded Nextracker (NXT) to Outperform from Market Perform with a $45 price target. The firm expects the stock to rise further as the merger arbitrage bets settle in and the stock begins being driven by fundamentals.

Jefferies downgraded Bath & Body Works (BBWI) to Hold from Buy with a price target of $30, down from $45. The firm sees limited growth opportunities for the company after its data across social, foot traffic, and market share suggested a slowing of trends.

KeyBanc downgraded Thermo Fisher (TMO) to Sector Weight from Overweight without a price target. During the earnings call, Thermo provided "a lot of moving parts" with its 2024 macro view of zero or low-single-digit industry decline and its 3% growth goal, the firm tells investors in a research note.

BofA downgraded Fortive (FTV) to Neutral from Buy with a price target of $70, down from $87, after the company reported Q3 core revenue growth of 2.5% that was below the firm's estimate and prior guidance of 3.5%-4.5% year-over-year growth.

BofA downgraded F5 Networks (FFIV) to Underperform from Neutral with a price target of $160, down from $165. The firm expects revenue growth to remain muted, calling for it to be down 2% and up 4% over the next two years, respectively.

Roth MKM downgraded MaxLinear (MXL) to Neutral from Buy with a price target of $18, down from $35. The company reported revenue slightly behind consensus but guided another decline for Q4 below consensus growth expectations, the firm notes.

BofA initiated coverage of Paycom (PAYC) with a Buy rating and $330 price target. The firm thinks Paycom is well positioned to continue gaining share with "a leading SaaS offering and a highly efficient model."

BofA initiated coverage of Paylocity (PCTY) with a Neutral rating and $210 price target. While stating that fundamentals "appear attractive," the firm also notes that new customer adds slowed in FY23 despite an increase in sales and marketing costs, which may suggest a slowdown in margin progression in the near-term.

BMO Capital initiated coverage of Procore Technologies (PCOR) with an Outperform rating and $80 price target. With a strong core business in project management, multiple drivers to expand logos, a long-term platform vision to capture more workflows, and margins approaching an inflection to sustained breakeven over the coming year, estimates have "upward tension," the firm tells investors in a research note.

Cantor Fitzgerald initiated coverage of Rocket Lab (RKLB) with an Overweight rating and $6 price target. The firm believes the company benefits from a "proven and successful" launch track record, diversified and recurring customer base, and multiple launch complexes with vertical integration.

RBC Capital initiated coverage of 4D Molecular (FDMT) with an Outperform rating and $25 price target. The shares trading close to cash "creates an attractive buying opportunity" given the company's differentiated platform tailoring gene therapy to specific tissue, the firm says.

この記事が気に入ったらサポートをしてみませんか?